Cross-border EC made easy with Stripe and OPTI

- interview (i.e. television, newspaper, etc.)

- Integration with Stripe

- Benefits of Stripe x OPTI

- Stripe Tour Tokyo 2024

Interview with Stripe x OPTI

Integration with Stripe

Advantages

The benefits of the integration between Stripe and Opti are as follows

1. integration advice

Because Opti is a Stripe partner, we can respond to questions about Stripe products such as Stripe Payment, Stripe Billing, and Stripe Tax. Therefore, we can provide advice on what products to combine and how to file taxes.

2. tax advice

In addition to integration advice, we can also provide tax advice. We can explain which countries you should register for tax, whether you need to register for tax in the first place, and when you need to start registering for tax and filing tax returns.

3. tax filing and payment after settlement

After settlement, you will need to deal with tax payments and tax returns. OPTi offers tax registration and filing in 90 countries, as well as solutions for these tax payments.

4. implementation of tax engines

We deal with a variety of tax engines and can recommend the most suitable tax engine for your client company. We can also offer a variety of tax engines that can be easily integrated with Stripe.

For the above reasons, we would like to ask you to consider Opti together with Stripe.

Businesses seeking to expand their global EC services around the world

Digital Sales Customers

- E-Books

- E-Comics

- Subs

- Fan Business

- Online Games

Physical Goods Sales Customers

Physical Goods Sales Customers

- Clothing (Apparel)

- Medical supplies

- Things made in Japan

Talk to Opti about tax planning for overseas expansion

Please feel free to ask us about tax planning for each country when expanding overseas.

Cross-border EC Customer Challenges

Many customers have trouble developing their business because they do not know the amount of taxes and penalties they will have to pay such as value-added taxes and customs duties overseas and the magnitude of the risk.

As a non-resident company, it is often an unprecedented experience for the Japanese headquarters to register and file taxes locally, and many companies have trouble registering, filing, and paying taxes overseas.

Many customers are not sure what tools to use in what combination or how to integrate and configure them.

OPTI and Stripe collaboration can be used.

Increased indirect tax risks due to business digitization and globalization

Corona Disaster Accelerates Business Digitization

As of 2024, the Corona Disaster has made many businesses digital. While software sales used to be based on the sale of single data items, there are many cases where these have also changed to subscription-based services.

For example, Google's Gmail and Salesforce, a CRM software, are now cloud services. In the area of product sales, many businesses are now using Shopify and Amazon for cross-border e-commerce sales. This digital shift in business is taking place all over the world.

There is also a move away from platform to settlement.

In January 2024, the U.S. Supreme Court rejected an appeal in a lawsuit against Epic over the App Store. As a result, the High Court ruling became effective.

The High Court had earlier ruled to allow developers to direct iPhone users to options outside of Apple's system, allowing them to purchase apps more cheaply on outside systems.

Apple had been charging developers up to 30% commission for the sale of digital goods and services through the Apple Store. As a result of the Supreme Court ruling, many SaaS and gaming vendors are expected to move to buying and selling on their own sites rather than through Apple, which charges a 30% fee. This is because the typical credit card transaction only requires a 4-5% fee.

On the other hand, the risk of international indirect taxes arising

The January 2024 U.S. Supreme Court ruling was a victory for many gaming and payment companies that sell digital services on the App Store and GooglePlay.

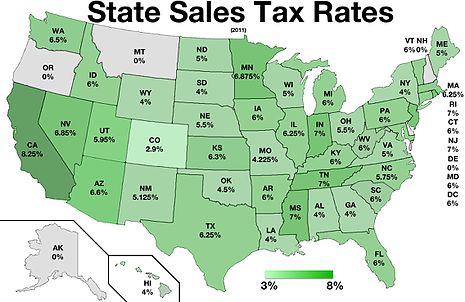

On the other hand, these companies will be obligated to pay local indirect taxes when making payments in different locations than the platformer. In the U.S., for example, the South Dakota v. Wayfair decision made the sales tax economic nexus effective. As a result, a local sales tax return is triggered when sales exceed a certain threshold ($100,000 or 200 transactions within the state in a year, depending on the state). (*) In addition, Japanese companies in the EU and the UK are liable for local VAT levy, collection, and payment if they make digital sales to consumers in these regions.

While this increasingly digital world creates many business opportunities, it should be noted that local tax registration and tax filing obligations will arise. Failure to comply with these obligations can result in overdue taxes and penalties, and in the worst case, management may face local criminal penalties. For this reason, especially for listed companies, it is necessary to first consider local indirect tax risks when expanding globally.

Short tax filing deadlines and complex international taxation

Tax returns generated monthly

The worldwide tax filing schedule is fast, based on tax returns in Japan. Japanese corporate tax and consumption tax returns have a taxable period of one year, after which it is mandatory to file within two months.

On the other hand, VAT returns in France and Germany are filed monthly, so each month is the taxable period and tax returns must be filed until the 10th of the following month (Germany). In the case of the U.S., each state is required to file its own tax return, so if you are just expanding your game across the U.S., you will have to file tax returns for 45 states.

The accounting department, which until now had focused on Japanese taxation, now had no choice but to understand tax returns from around the world and select an outside vendor. The key factor in this selection process is whether to use a firm that can handle only one country's taxes or a firm that can handle all of the world's tax returns at once. Even with different tax firms for each country, dealing with these firms can be very cumbersome, including differences in language, time zones, culture, and time zones. For this reason, a practical solution may be to use a firm that can assist you in filing taxes worldwide.

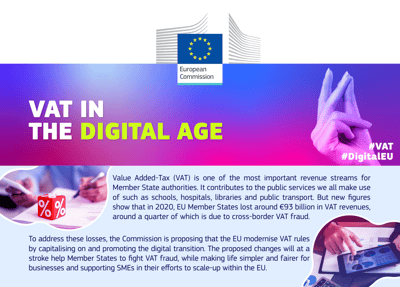

Worldwide Electronic Invoice Declaration Compliance to be Filed within 4 Days of Transaction

In addition to these tax declarations, electronic invoice systems are being revised in various parts of the world; in the EU, a system called ViDA (VAT in the Digital Age) has been launched. In Japan, the Peppol system will be used to file electronic tax returns. Eventually, however, it is expected to approach a common method of declaration throughout the world.

In a world where electronic invoice filing has not been implemented until now, businesses could simply submit invoices to different businesses. However, from now on, every time a business submits an invoice to a different entity, it will be obligated to simultaneously submit the tax authority data for each country through that country's own electronic invoice declaration system.

The requirements for each country are different. Some countries require structured electronic invoice declarations within a few days of a transaction, while others require that the data be stored in the invoice language, etc.

The work performed by the accounting department of a global business used to be enough to handle internal and consolidated accounts, but in the digital world, it will be necessary to centralize transactions for all global locations in a single ERP and to mandate and monitor invoice declarations within a few days of each transaction for each location.

Since invoice declarations must be made for each transaction, it is a world that is beyond human control. Even if you use an electronic invoice service that is compliant with the Japanese system, it will not be sufficient to handle e-Invoice declarations worldwide in the era of VAT in the Digital Age.

Difficulty in tax calculation due to increased number of transactions

Market Size vs. Complexity of Sales Tax Compliance

The United States has always been a superpower. It is also the largest exporter of games and electronic comics. The U.S. is the first country that Japanese companies target for digital sales and cross-border e-commerce sales. This is because the market is very large.

However, only considering the positive aspects of a large market can be a painful experience. The U.S. is required to deal with the infamous "sales tax.

For example, if you are selling cross-border e-commerce with local inventory, that alone will generate a physical nexus in many states, and you will be required to file a local sales tax return.

In addition, it is common for e-commerce and digital sales sites to calculate and display the local tax amount in addition to the product price. Some countries also require that the exact local tax amount be displayed on the sales website to protect consumers.

On the other hand, displaying these tax amounts on the site is extremely complicated.

One problem is the number and complexity of tax items, such as state, county, and city taxes. Take the U.S. sales tax, for example: in addition to the state sales tax, there is a complex interplay of county and city taxes. A $10 hamburger purchased at a Dodgers ballpark would cost $10.95, which is 9.5% including the California sales tax of 6% as well as other city taxes. On the other hand, at the Yankees stadium, 4% state sales tax and 4.88% city tax are added, for a total of 8.88%. Thus, when calculating the price of goods in the U.S., it is necessary to take into account county and city taxes in addition to state sales tax.

With such a large number of states, counties, and cities and tax jurisdictions, there is a difficulty in ascertaining the latest taxation of these taxes. It is said that there are 2,895 tax jurisdictions in the U.S., including counties and cities, in addition to states, and it is not easy to check all of them.

In addition, the tax rates in these jurisdictions change frequently. In 2021, there were 606 tax rate changes, and in 2022, there were 542 tax rate changes. This means that once tax rates are entered into a company's database, they can easily become obsolete after one year. This makes accurate tax calculation a very difficult problem in practical terms.

The complexity of the combinations is 300 million.

In addition to the problem that there are more than 2,800 jurisdictions and that the tax rate changes more than 500 times a year, the U.S. tax rate changes depending on the combination of the warehouse location from which the shipment originates and the zip code of the shipping address designated by the consumer, whether the transaction is a resale business or not, whether the transaction is tax-exempt or not, the products sold, and other factors. These calculations are said to be 300 million different ways.

In the case of e-commerce sites and digital sales, the location of the buyer must be selected, frequently changing tax rates must be managed, and the appropriate amount of tax must be levied and collected instantly when a consumer makes a purchase. Moreover, since each digital business is less than $10 per transaction, it is not possible to seek a written opinion from a tax consultant each time. Ultimately, the only realistic option is to install a tax engine on the sales site.

Introduction of a tax engine is essential to prevent indirect taxes in the digital business world.

In a world where 300 million tax combinations occur in the U.S. alone, e-goods sellers who sell a huge number of goods for a small amount of money all over the world will certainly have to develop their business by installing a tax engine on their website.

Sooner or later, all global companies and digital companies doing business globally will be faced with such a situation.

For example, "game companies," "e-cartoon companies," "broadcasters," "SaaS companies," "electronic music distribution companies," and "fan sites" need to take these measures because of the huge number of transactions and worldwide sales.

Companies that fail to take these tax filing measures will suddenly receive a letter from the tax authorities demanding the payment of huge overdue taxes and penalties. If your company is a publicly traded company, how will you explain this to investors and shareholders?

Directors' duty of care can no longer ignore international indirect tax measures.

Since information on tax amounts and thresholds is known in advance, cross-border EC can be handled with peace of mind. Any uncertainties can be clarified through written opinions and meetings.

If we receive the data from Stripe, we can prepare tax returns directly from the data. In addition, we can handle tax payments as well. Therefore, even companies with concerns about cross-border EC can proceed without problems.

OPTi has many customers with many cross-border EC tools, so we can propose the best cross-border EC tools based on these examples.

Opti's Strengths in Global EC

MyOPTI allows accounting departments unfamiliar with international taxation

Based on our experience in assisting clients with tax returns in numerous countries, we have developed our own MyOPTI, a tool specialized for "tax registration," "tax filing," and "tax advice," which is available to our clients. Even after a former employee leaves the company, you can check where past tax returns are located and what kind of communication took place. We have tooled up the knowledge we have gained from tax returns in 70 countries around the world. The system is available in Japanese and English and in multiple languages, so it can be used at overseas locations as well.

We are a Collaboration firm of Andersen Global in Japan

With digitization and globalization comes the obligation to file taxes around the world. Since our founding in 2010, OPTI has supported tax reporting in many parts of the world. As a result, we have assisted more than 3,000 companies with their tax returns over the past 14 years, and have knowledge based on a great deal of experience. In recognition of these achievements, we have become a Collaboration Firm of Andersen Global in 2024.

Stripeとオプティとの連携

Stripeでは決済や税額の算出、その他不正検知など様々な機能がございます。オプティではStripeデータを元ににして税額算出や税申告を実施します(税申告/納税/しきい値モニタリング/過去申告/税務署とのレター対応)

Opti Operations

Since its establishment, OPTi has supported tax filing and system implementation in 70 countries around the world, rather than simply being a tax filing agent in a few countries under the motto "Tax * IT = Performance". As a result, we have assisted many major companies with their tax returns.

Tax Risk Analysis

Stripe Tour Tokyo 2024

We introduced our solutions to many visitors at Stripe Tour Tokyo 2024 held at Toranomon Hills on July 18, 2024. If you have any questions about global EC payment and taxation, please contact us.

.jpg?width=4032&height=3024&name=IMG_5740%20(2).jpg)

Frequently Asked Questions

We have compiled a list of frequently asked questions for our company.

The benefits of the integration between Stripe and Opti are as follows

1. integration advice

Because Opti is a Stripe partner, we can respond to questions about Stripe products such as Stripe Payment, Stripe Billing, and Stripe Tax. Therefore, we can provide advice on what products to combine and how to file taxes.

2. tax advice

In addition to integration advice, we can also provide tax advice. We can explain which countries you should register for tax, whether you need to register for tax in the first place, and when you need to start registering for tax and filing tax returns.

3. tax filing and payment after settlement

After settlement, you will need to deal with tax payments and tax returns. OPTi offers tax registration and filing in 90 countries, as well as solutions for these tax payments.

4. implementation of tax engines

We deal with a variety of tax engines and can recommend the most suitable tax engine for your client company. We can also offer a variety of tax engines that can be easily integrated with Stripe.

For the above reasons, we would like to ask you to consider Opti together with Stripe.

It is a declaration in which structured data is submitted to the tax authorities of each country within a few days of each transaction.

As a member of the Digital Invoice Promotion Council, we are constantly researching and reviewing the latest electronic invoice filings from around the world to assist our clients in filing e-Invoices worldwide.

Talk to Opti about tax planning for overseas expansion

Please feel free to ask us about tax planning for each country when expanding overseas.

" It seems to me that OPTI provides very unique tax services with deep knowledge. we Ricoh has chosen OPTI because of such reasons."

Flow to Global Tax Filing DX

Opti supports global tax returns and is developing and DXing strategies for these tax returns and tax management. In addition, we can handle your tax returns with our partners in 150 countries around the world.

status quo analysis

With an eye on your company's medium- to long-term plans, we will analyze your current situation in terms of both the commercial and international tax aspects of your business over the next 5-10 years, as well as your future goals, constraints, and business challenges.

Proposal

We will present you with the best global tax filing and regulatory solutions based on the country you are entering and the requirements you need.Project Start

We will register your company for tax in the target country. If there is already taxable activity in the past, we negotiate with the local tax authorities to pay past taxes, delinquent taxes, and interest.

Tax Technology Implementation

We implement the latest tax technology in your system. If you require IT development for your company, we can do so for an additional fee. We also provide training for your international tax staff and support for system integration.Toward DXing of Tax Returns

Dashboarding of worldwide tax returns to enable you to check the status of your returns. We will build a dashboard for your company to avoid delays in filing tax returns by country, and prevent tax and e-Invoice returns from falling through the cracks.